Don't hesitate to contact us

+305-445-2920

info@workmagic.com

Mon-Sun 9:00 - 7:00

WorkMagic Backup and Recovery Services

Cloud Backup

Backup and Recovery Services

Accelerate data-first modernization by radically simplifying data management with the industry’s most comprehensive solution to store, manage, and protect data across hybrid cloud.

- Simplify with a self-service cloud on demand

- Modernize data protection across hybrid cloud

- Transform with flexible, intuitive storage

- Backup as a service built for hybrid cloud.

Accelerate data-first modernization by radically simplifying data management with the industry’s most comprehensive solution to store, manage, and protect data across hybrid cloud.

- Simplify with a self-service cloud on demand

- Modernize data protection across hybrid cloud

- Transform with flexible, intuitive storage

- Backup as a service built for hybrid cloud.

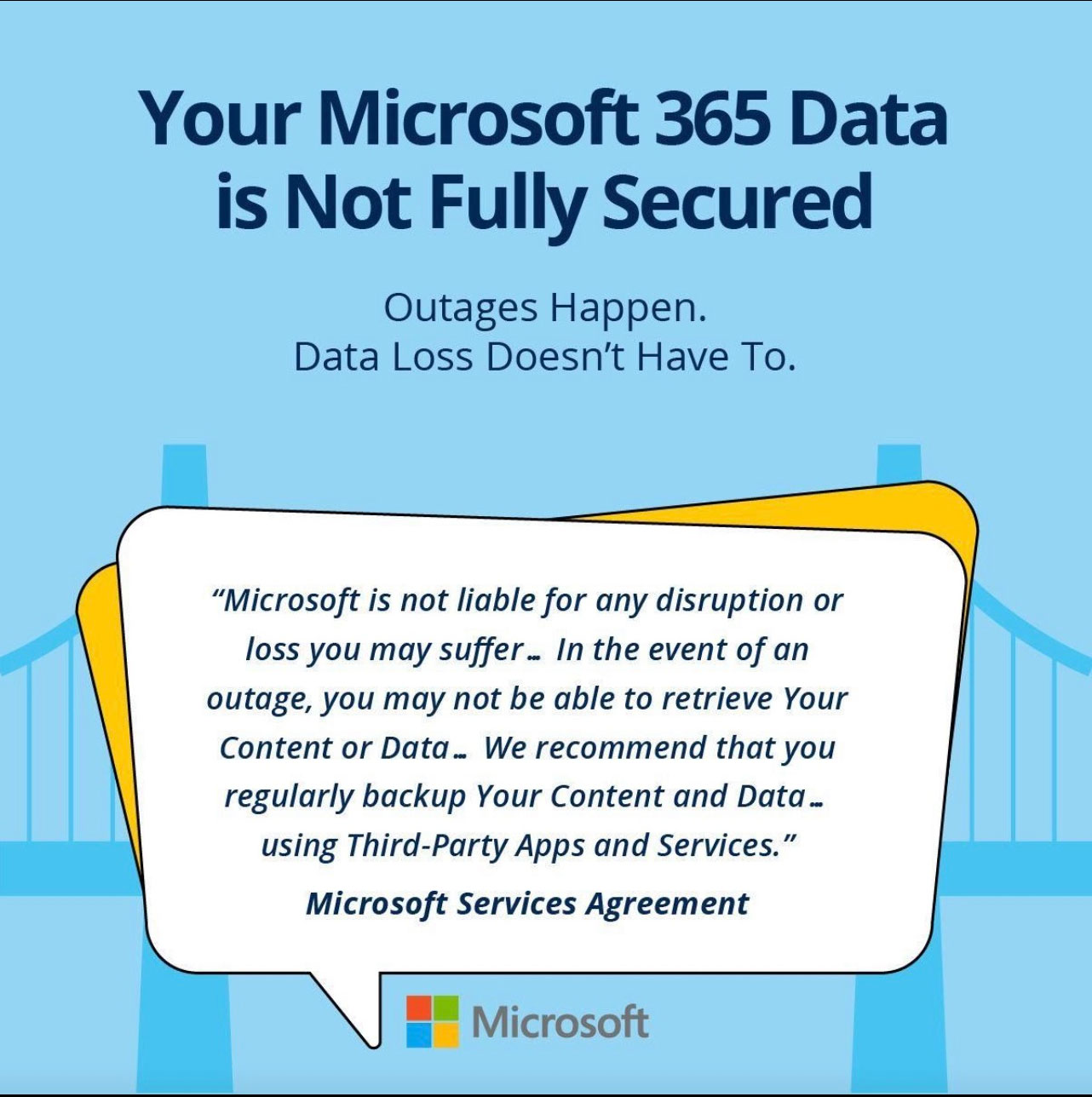

Backup Microsoft 365

E-Mail, SharePoint, Teams and more.

Backup GSuites

Your backup of Google Workspace

FREQUENTLY ASKED QUESTIONS

Microsoft provides certain backup and recovery features for its Office 365 (which includes Microsoft Teams) services, but it's important to understand the limitations and responsibilities of these features.

Data Replication and Geo-Redundancy: Microsoft replicates Office 365 data across different data centers to ensure availability and durability. This means in case of a major data center failure, your data remains secure and accessible. However, this should not be confused with a traditional backup.

Retention Policies: Office 365 allows administrators to set retention policies. This can be used to preserve data for a set period, even if it's deleted by users. However, these policies are primarily for compliance and not a replacement for a comprehensive backup solution.

Recycle Bin: Deleted items in various Office 365 services, like SharePoint or OneDrive, go to a recycle bin, where they can be recovered for a limited time. However, this is not a full-proof backup solution and is limited in scope and duration.

Point-in-Time Restoration: Microsoft does not typically offer point-in-time restoration of Office 365 data. This means if data is lost or corrupted, it might not be possible to restore it to a previous state as you would expect from a traditional backup.

Shared Responsibility Model: Microsoft follows a shared responsibility model for data integrity in Office 365. While Microsoft is responsible for the infrastructure and ensuring the services are running, the responsibility of protecting the data (like emails, files, and chat records) lies with the tenant. This means users and organizations should consider implementing their own backup solutions to complement what Microsoft offers.

In summary, while Microsoft provides certain safeguards for data in Office 365, these should not be viewed as a complete backup solution. Organizations are advised to use additional backup solutions to ensure full protection of their data.

Google Workspace (formerly known as G Suite) does provide some data protection and backup functionalities, but it's important to understand their scope and limitations:

Data Replication and Geo-Redundancy: Google Workspace replicates data in multiple geographically dispersed data centers. This ensures high availability and protects against data loss due to hardware failures and other physical disruptions. However, this is not the same as traditional backup and does not protect against user errors or malicious deletions.

Versioning and File Recovery: Services like Google Drive within Google Workspace offer version history for files, allowing users to revert to previous versions. Deleted items in Google Drive are also retained in the Trash for a certain period, during which they can be recovered.

Retention Policies with Google Vault: Google Vault is a feature available in some Google Workspace editions that allows for data governance and eDiscovery. It can be used to set retention policies for data like emails and chat messages, ensuring they are retained for a set period for legal or compliance reasons. However, Google Vault is not a backup solution in the traditional sense.

Shared Responsibility Model: Similar to other cloud service providers, Google follows a shared responsibility model. Google is responsible for the infrastructure's integrity and availability, but the responsibility for protecting the data within Google Workspace lies with the users. This means accidental deletions, data corruption due to user errors, or malicious attacks are the user's responsibility to guard against.

Lack of Point-in-Time Recovery: Google Workspace does not typically offer a point-in-time recovery feature for its services, which is a key aspect of traditional backup solutions. If data is corrupted or lost, restoring it to a previous state is not straightforward without external backup solutions.

In conclusion, while Google Workspace provides certain data protection features, these should not be mistaken for comprehensive backup solutions. Users and organizations are advised to use additional backup tools and practices to ensure complete protection and easy recovery of their data. This includes regular backups and possibly using third-party backup services designed for Google Workspace.

In today's interconnected digital landscape, small and medium-sized businesses (SMBs) are not immune to the ever-growing threat of cyberattacks. As cybercriminals become more sophisticated, the need for robust cybersecurity measures has never been more critical. One essential component of a comprehensive cybersecurity strategy for SMBs is cyber insurance. In this blog post, we'll explore why your SMB should consider investing in cyber insurance to safeguard its digital assets and operations.

1. Rising Threat Landscape

The threat of cyberattacks is on the rise, with SMBs increasingly becoming attractive targets. Hackers often perceive smaller businesses as easier prey, as they may lack the extensive cybersecurity measures that larger enterprises have in place. Cyber insurance acts as a financial safety net, helping SMBs mitigate the risks and costs associated with these evolving threats.

2. Financial Protection Against Data Breaches

Data breaches can have severe financial implications for SMBs. Cyber insurance provides financial protection by covering the costs associated with data breaches, including forensic investigations, legal fees, and the expenses related to notifying affected customers or clients. This coverage ensures that the financial burden of a data breach doesn't cripple your business.

3. Compliance with Data Protection Laws

With the introduction of data protection laws such as GDPR, CCPA, and others, businesses are under increasing pressure to ensure the security and privacy of customer data. Non-compliance can result in hefty fines. Cyber insurance helps SMBs meet regulatory requirements by covering the costs associated with fines and penalties for non-compliance.

4. Business Interruption Coverage

In the event of a cyber incident, business operations can come to a grinding halt. Cyber insurance often includes business interruption coverage, compensating SMBs for lost income during the downtime caused by a cyberattack. This ensures that your business can recover and resume operations without suffering significant financial losses.

5. Protection Against Third-Party Liability

Cyber incidents can extend beyond your organization and impact third parties such as customers, partners, and vendors. Cyber insurance provides liability coverage for legal defense costs and settlements in the event of lawsuits arising from a cyber incident. This protects your SMB from the potential financial fallout of third-party claims.

6. Rapid Incident Response Support

In the aftermath of a cyberattack, time is of the essence. Cyber insurance often includes access to specialized cybersecurity professionals who can assist with swift incident response. Having experts on hand to guide your business through the recovery process can significantly reduce the impact of a cyber incident.

7. Reputation Management

A cyber incident can tarnish your business's reputation, eroding customer trust and loyalty. Cyber insurance may cover the costs of public relations efforts to manage and repair your company's image. This proactive approach helps minimize the long-term damage to your brand.

Conclusion

In conclusion, cyber insurance is a crucial component of a holistic cybersecurity strategy for SMBs. It provides financial protection, supports regulatory compliance, and helps businesses recover swiftly from cyber incidents. With the increasing frequency and sophistication of cyber threats, investing in cyber insurance is not just a precautionary measure but a strategic necessity to ensure the resilience and sustainability of your SMB in today's digital era.

If you're ready to safeguard your SMB against the growing cyber risks, consider exploring our cyber insurance solutions at WorkMagic. Our team is here to help you navigate the complex landscape of cybersecurity and provide the protection your business needs. Don't wait until it's too late – secure your digital future with WorkMagic cyber insurance today.